IDBI Balance Check: IDBI Bank Limited is generally known as IDBI Bank or IDBI. This bank is an Indian private-sector bank. a subsidiary of Life Insurance Corporation (LIC) offering banking and financial facilities. If you want to check your IDBI Balance, you can read the steps related to it as provided in the below section. IDBI was started in 1964. The Industrial Development Bank of India initiates it. It is just like a development finance institution that offers financial facilities to the industrial sector. In 2005, the institution and its commercial division, IDBI bank balance check, set up the present-day banking outfit. It was separated into the “other public sector banks” category. Reserve Bank of India re-categorized IDBI SMS Banking as a private bank. Several national institutes have roots in IDBI Balance Enquiry Number, such as the National Stock Exchange of India, SIDBI, India Exim Bank, and National Securities Depository Limited. To grab the rest of the details, IDBI Bank missed call, you may read the article as follows.

IDBI Bank Balance Check Number 2023

Table of Contents

- 1 IDBI Bank Balance Check Number 2023

- 2 Overview IDBI Bank Balance Check Number 2023

- 3 About IDBI

- 4 IDBI Bank Contact and Enquiry Details

- 5 IDBI SMS Banking

- 6 Through ATM

- 7 Through Internet Banking

- 8 Through Mobile Banking

- 9 How To Check IDBI Balance?

- 10 IDBI Balance Enquiry Number

- 11 Requirements to Use IDBI Bank Balance Enquiry Facility

- 12 IDBI Bank missed call

- 13 FAQ’S IDBI Bank Balance Check Number 2023

IDBI Bank, a prominent public sector bank in India, has served the nation for 56 years since its establishment in 1964. With a vast customer base, it provides a wide range of financial services, including debit and credit facilities, to millions of customers nationwide. The bank also offers services such as insurance coverage, savings account openings, loan options, and investment opportunities.

In line with technological advancements, IDBI Bank Limited offers its customers a comprehensive suite of banking services, including online banking for tasks like balance inquiries, statement checks, fund transfers, and receipt of funds. In this article, we will specifically discuss the methods for conducting balance inquiries, allowing customers to access detailed transaction information and ascertain their account balance easily.

Overview IDBI Bank Balance Check Number 2023

| Name of Bank | Industrial Development Bank of India |

|---|---|

| Short Form | IDBI |

| Subsidiaries | – IDBI Intech |

| – IDBI Capital Markets & Securities | |

| – Asset Management | |

| – IDBI MF Trustee Company | |

| – IDBI Trusteeship Services | |

| Year | 2023 |

| Managed By | – Life Insurance Corporation |

| – Government of India | |

| Article Name | IDBI Balance Check, IDBI Net Banking Balance Check Number 2023 |

| Category | Balance Check |

| Official Website | idbibank.in |

About IDBI

To promote transparency and enhance information accessibility, IDBI has set up Central Assistant Public Information Officers (CAPIOs) in different branches and the Bank’s Staff Training College. This arrangement enables any person, referred to as a “citizen,” to submit a written or electronic application in English, Hindi, or the local language of the region, along with the required fee (Rs. 2,000). The application aims to acquire particular information.

The prescribed fee can be remitted per the guidelines outlined in Section 3 of the RTI (Regulation of Fee and Cost) Rules, 2005. Payment can be made through cash, banker’s check, demand draft, or an Indian Postal Order. The payment should be made in favor of IDBI Bank Limited and payable in Mumbai. It is imperative to obtain a valid receipt from the concerned CAPIO or CPIO as proof of payment. It is important to note that Court Fee Stamps are not accepted as a mode of payment for requesting Bank information.

IDBI Bank Contact and Enquiry Details

For various inquiries and assistance, IDBI Balance Enquiry Number provides several toll-free numbers and SMS services to cater to your needs.

General Enquiries: For queries regarding Loans, Deposits, Service charges, Rate of interest on Deposit/Loans, and information related to ATMs, you can contact:

- Toll-free number: 1800 200 1947

- Toll-free number: 1800-22-1070

Debit Card Blocking: In case your Debit Card needs to be blocked, you can do so through the following methods:

- Toll-free number: 1800-22-6999

- SMS BLOCK < Customer ID > < Card Number > to 5676777 (If you remember your Card number)

- SMS BLOCK < Customer ID > to 5676777 (If you IDBI Balance Enquiry Number don’t remember your Card number)

Anti-Corruption Hotline: To report any concerns related to corruption, you can call:

- Toll-free number: 1800-22-8444 (10.00 am to 6.00 pm)

Credit Card Queries: For inquiries related to Credit Cards, you can reach out to:

- 24-Hour Customer Care Toll-free number: 1800 425 7600

- Non-Toll-free number: 022 – 4042 6013 (Call Charges Applicable)

- Email: [email protected]

IDBI SMS Banking

Customers with Savings, Current, or Fixed Deposit accounts at IDBI Bank can benefit from SMS Banking. This service is offered at no cost, although some telecom providers may levy a small fee for IDBI SMS Banking. To use the balance check function of IDBI SMS Banking, simply send an SMS with the message “BAL CUSTOMER ID PIN [ACCOUNT NUMBER]” to either 9820346920 or 9821043718.

For details on the three latest transactions, send an IDBI SMS Banking to the same numbers with the subject line “TXN CUSTOMERID PIN [ACCOUNT NUMBER].”

| Business Request | Input |

|---|---|

| Balance enquiry | BAL CUSTOMERID PIN [ACCOUNT NUMBER] |

| Example: | Bal 400001 aaaaa |

| (Spaces would separate all fields). Account | |

| Account number is optional. By default, information is | |

| available for primary account number. | |

| Fixed deposits enquiry | FD CUSTOMERID PIN [ACCOUNT NUMBER] |

| Example: | Fd 400001 aaaaa |

| (All fields would be separated by spaces). Account no | |

| is optional. | |

| Last 3 Transactions | TXN CUSTOMERID PIN [ACCOUNT NUMBER] |

| Example: | Txn 400001 aaaaa |

| (Spaces would separate all fields). Account no | |

| number is optional. | |

| Cheque Payment Status | (to ascertain whether the cheque is paid or not) |

| Example: | Cps 400001 aaaaa |

| (All fields would be separated by spaces). Account | |

| number is optional. | |

| Request for cheque book | (Spaces would separate all fields). Account |

| NUMBER] | |

| Example: | (Spaces would separate all fields). Account |

| (Spaces would separate all fields) | |

| number is optional. | |

| Request for statement | one can use this reference number to check the status |

| of the request any time. The bank mails the statement | |

| of account. | |

| Example: | Stm 400001 aaaaa 0899 1200 |

| (Spaces would separate all fields). | |

| From date MMYY | |

| To date MMYY | |

| Account number is optional. | |

| Change of PIN | CPN CUSTOMERID OLDPIN NEWPIN |

| Example: | Cpn 400001 aaaaa bbbbb |

| (All fields would be separated by spaces). |

Through ATM

When using the ATM-cumulative debit card provided by IDBI Bank, you can conveniently access your account’s ATM balance inquiry service. Ensure that your PIN and ATM card are up-to-date before proceeding. Here are the steps to follow:

- Visit the nearest IDBI Bank ATM.

- Alternatively, you can use the IDBI Bank balance check service at ATMs that IDBI Bank does not own.

- Insert your debit card into the ATM, input your 4-digit ATM PIN, and then select the “Balance Enquiry” option.

- The available balance in your IDBI Bank account will be displayed on the ATM screen instantly.

Through Internet Banking

The online portal offers access to balance inquiry services for IDBI Bank customers enrolled in net banking services. You can check your account balance by following these steps:

- Visit the IDBI Bank’s online banking portal.

- Account holders can enrol for net banking services:

- During the account opening process.

- Later on, through online registration.

- In person at the bank.

- Once registered, use your username and password to access the portal.

- The portal offers banking services, including mini-statements, balance checks, fund transfers via NEFT/RTGS, and IMPS.

- Click the “Balance Enquiry” tab to access your IDBI account balance information.

Through Mobile Banking

IDBI Bank offers its account holders the convenience of accessing their banking details through two mobile apps, IDBI Bank mPassbook and IDBI Bank GO Mobile+. These apps can be downloaded from the Google Play Store for Android devices and the Apple Store for iOS devices. The process of checking your IDBI account balance through mobile banking involves the following steps:

- Download and install the preferred IDBI Bank mobile banking app using your banking credentials.

- Log in to your bank account using your credentials.

- Navigate to the “Manage Accounts” section within the app.

- Choose the “Balance Enquiry” option.

- Submit your request.

How To Check IDBI Balance?

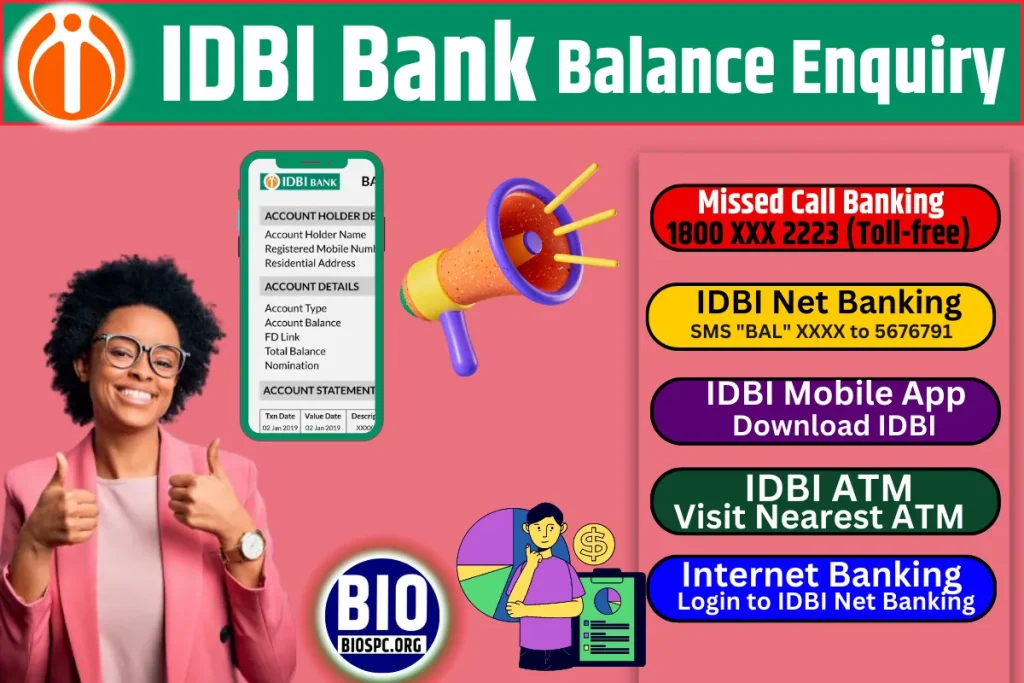

There are three ways to do the IDBI Balance Enquiry i.e.: dialing the toll-free number and doing the missed call for a balance inquiry. Here you can check the IDBI Balance Check Process in detail.

IDBI Balance Enquiry Number

- The IDBI bank cardholders may check balances utilizing the bank’s official inquiry number. They may dial a missed call number i.e. 18008431122

- You can collect the last five mini-statement or transactions details, by giving a missed call to 18008431133.

Requirements to Use IDBI Bank Balance Enquiry Facility

- To use this free facility, your mobile number should have been registered for mobile banking services with IDBI Bank (IDBI)

- If your number is already registered with your bank, you can directly call the above listed number’s .

- If your mobile number is not registered, you will get an SMS as “Your mobile number is not registered for this service”, then please follow registration procedure or Visit o IDBI Bank Branch and Register your Mobile number with your IDBI Account.

- If you have multiple savings accounts with the same bank, the default account will be the latest opened account and you will be able to check only default account balance…

- Some banks limit the no of times that you can avail this facility in a day. For example – Bank of Baroda customers can avail this facility maximum “5 times a day”. Bank of India Customers can avail this facility maximum “2 times in a day”

- This service is available on domestic mobile numbers only

IDBI Bank missed call

- Give a missed call to 18008431122 if you need balance details.

- Confirm the call from your active mobile number linked to your bank account.

- The call will disconnect automatically after a few rings.

- Receive an SMS from the bank containing your IDBI bank account balance on the provided number.

FAQ’S IDBI Bank Balance Check Number 2023

The IDBI Bank balance enquiry toll-free numbers are: 1800-209-4324, 1800-200-1947 1800-22-1070 For IDBI Bank balance enquiry, IDBI Bank missed call any of these numbers, select the prefer language and follow the IVR instructions to get a account-relate information.

To withdraw or deregister from IDBI Bank’s missed call service, type DELAccount Number and send SMS to 5676777 or 9820346920 or 9821043718. You will receive a confirmation message IDBI SMS Banking indicating the de-registration status from missed call service.

You can check your IDBI Bank mini statement by using any of the facilities provide by the bank. The facilities are- mobile banking, SMS banking, net banking, WhatsApp banking, dropping a missed call, and visiting a bank branch or ATM IDBI Bank missed call.